- Information about African countries

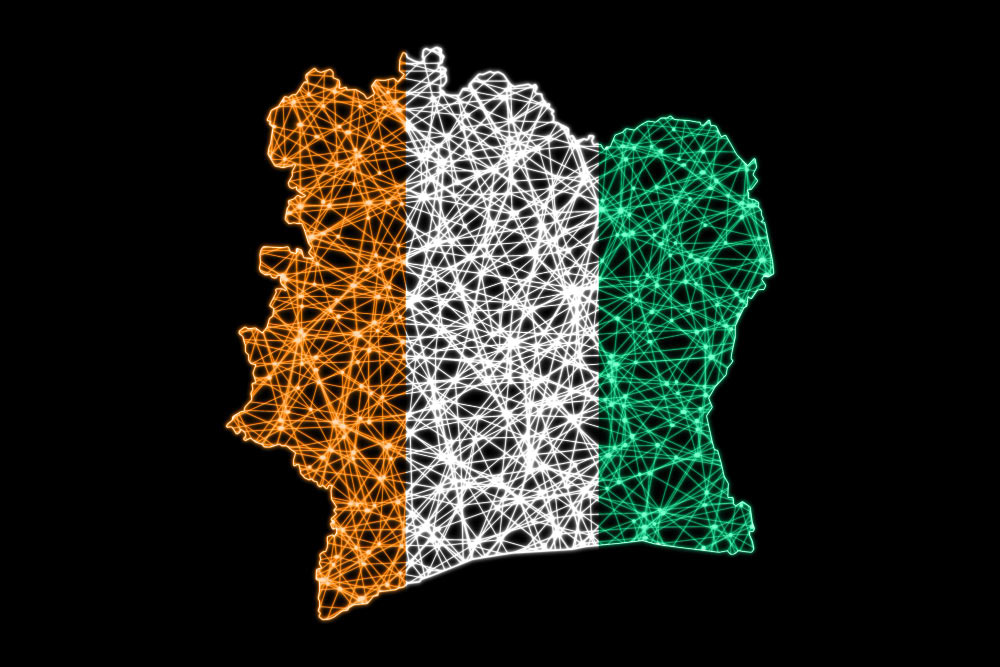

- west Africa

- East Africa

- North Africa

- South Africa

- Central Africa

Menu

Close

Menu

Latest News

- Importing gold from Africa, the best alternative to return foreign exchange earnings

- Raisi aims to enhance the connection between the Iranian diaspora and their country of origin.

- (July 18); Nelson Mandela International Day

- The busy trip of the president/signing of 12 documents and memorandum of cooperation between Iran and Zimbabwe

- The end of Raisi’s intensive trip to Africa/ signing of 21 cooperation documents between Iran and three African countries